Cares act payroll tax deferral information

Home » Trend » Cares act payroll tax deferral informationYour Cares act payroll tax deferral images are ready. Cares act payroll tax deferral are a topic that is being searched for and liked by netizens now. You can Get the Cares act payroll tax deferral files here. Get all royalty-free vectors.

If you’re searching for cares act payroll tax deferral images information related to the cares act payroll tax deferral keyword, you have come to the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

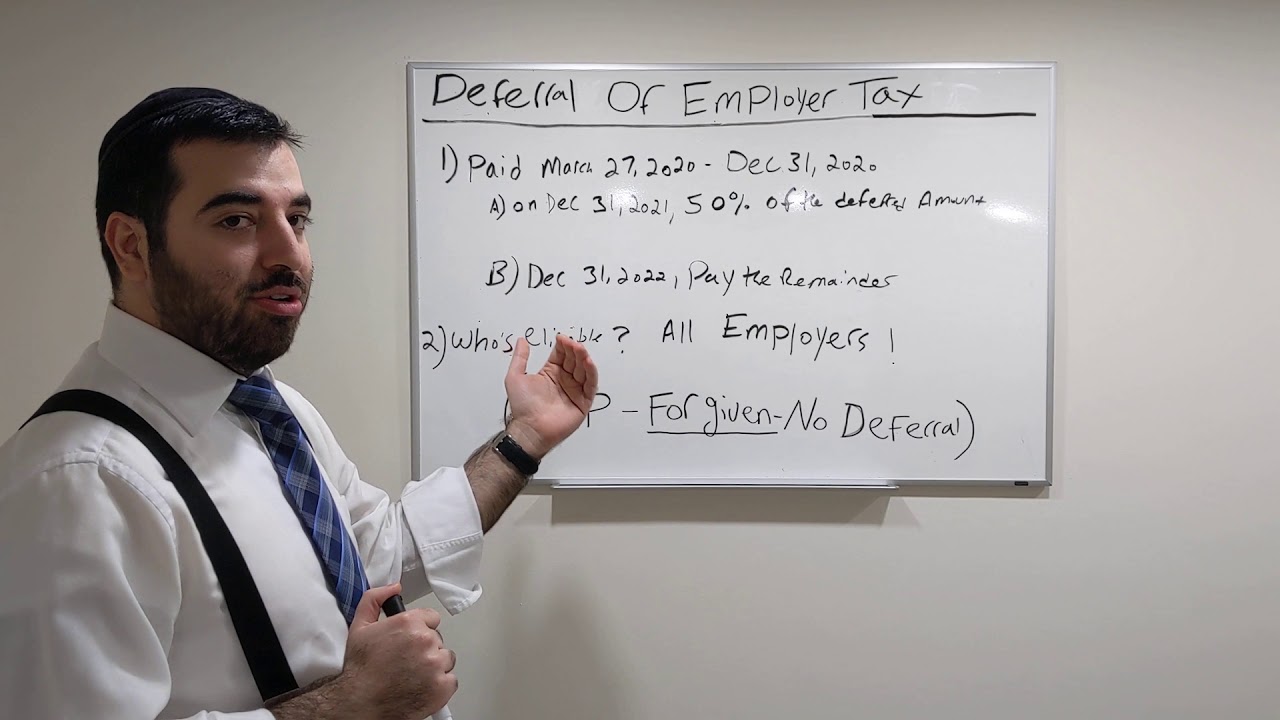

Cares Act Payroll Tax Deferral. Deferral of employer payroll taxes. Employers can make the deferral payments through the electronic federal tax payment system or by credit or debit card, money order or with a check. The deferral applies to deposits and payments of the employer�s share of social security tax. Employers who opt to delay payment would need to deposit half of that delayed amount by dec.

CARES Act Payroll Tax Deferral is a Fabulous Help to From youtube.com

CARES Act Payroll Tax Deferral is a Fabulous Help to From youtube.com

Section 2302 of the cares act only applies to taxes incurred from march 27th through dec. The cares act provides employers with a choice in the case of an otherwise eligible entity between (1) using the employee retention credit in conjunction with the payroll tax deferral, or (2) qualifying for an sba forgivable loan to fund payroll costs. Such deferred taxes are due in two installments: This content is for the first stimulus relief package, the coronavirus aid, relief and economic security act (cares act), which was signed into law in march 2020. Half of the deferred amount is due on december 31, 2021, and the other half is due on december 31, 2022. The deferral applies to deposits and payments of the employer�s share of social security tax.

The cares act temporarily allows business losses to be carried back to offset recent years’ taxable income and

Download payroll tax deferral pdf. National covid relief for businesses. How to repay the deferred taxes. Half of the deferred amount is due by dec. The coronavirus aid, relief, and economic security act (act) contains several business relief provisions, including an employer payroll tax deferral (deferral) and a companion provision allowing an employee retention credit (credit). The cares act allows an employer to defer payments of the employer portion of the social security tax.

Source: youtube.com

Source: youtube.com

The coronavirus aid, relief, and economic security act (act) contains several business relief provisions, including an employer payroll tax deferral (deferral) and a companion provision allowing an employee retention credit (credit). Section 2302 of the cares act enables employers to defer certain payroll taxes, specifically the employer contribution of federal insurance contributions act (fica) taxes, otherwise referred to as the employer’s portion of social security taxes. Deferral of employer payroll taxes. The cares act allows employers to defer payment for the employer portion of payroll taxes—6.2% for social security taxes—due from march 27, 2020, through december 31, 2020. Employers who opt to delay payment would need to deposit half of that delayed amount by dec.

Source: everence.com

The coronavirus aid, relief, and economic security act (act) contains several business relief provisions, including an employer payroll tax deferral (deferral) and a companion provision allowing an employee retention credit (credit). Half of the deferred amount is due on december 31, 2021, and the other half is due on december 31, 2022. This content is for the first stimulus relief package, the coronavirus aid, relief and economic security act (cares act), which was signed into law in march 2020. This provided cash flow relief to. The cares act requires that the employer, not the payroll service provider, is responsible for ensuring the deferred payroll tax is remitted timely by the applicable deferral date.

Source: xqcpahouston.com

Source: xqcpahouston.com

The cares act allowed businesses to elect to defer the employer�s share of social security tax on wages paid to employees between april 1 and december 31, 2020. 50% by december 31, 2021, and 50% by december 31, 2022. This relief applies to all employers, including governmental entities. Posted at 02:13h in blog by stephanie 0 comments. We expect that withheld amounts of income and payroll taxes remitted to the treasury department will jump in late december as a result of the payment of payroll tax amounts that were allowed by.

Source: youtube.com

Source: youtube.com

Typically, employers are required to pay 6.2 percent of social security taxes for each employee’s covered wages on a. In addition to potentially receiving the ssi tax credit, the cares act allows employers to defer the payment of the employer’s share of the 6.2% social security tax on wages paid beginning on march 27, 2020 and ending on december 31, 2020. Such deferred taxes are due in two installments: Deferral of social security tax deposits the cares act allows employers to defer deposits of their 6.2% share of the social security tax due from march 27, 2020, through dec. Half of the deferred amount is due on december 31, 2021, and the other half is due on december 31, 2022.

Source: trinet.com

Source: trinet.com

The cares act allows employers to defer payment for the employer portion of payroll taxes—6.2% for social security taxes—due from march 27, 2020, through december 31, 2020. 50% by december 31, 2021, and 50% by december 31, 2022. Deferral of social security tax deposits the cares act allows employers to defer deposits of their 6.2% share of the social security tax due from march 27, 2020, through dec. Payroll tax deferral cares act. Section 2302 of the cares act only applies to taxes incurred from march 27th through dec.

Source: czarbeer.com

Source: czarbeer.com

Section 2302 of the cares act only applies to taxes incurred from march 27th through dec. Payroll tax deferral and employee retention credit. The cares act allowed businesses to elect to defer the employer�s share of social security tax on wages paid to employees between april 1 and december 31, 2020. The cares act allows an employer to defer payments of the employer portion of the social security tax. Payroll tax deferral cares act.

Source: saltmarshcpa.com

Source: saltmarshcpa.com

National covid relief for businesses. The cares act provides employers with a choice in the case of an otherwise eligible entity between (1) using the employee retention credit in conjunction with the payroll tax deferral, or (2) qualifying for an sba forgivable loan to fund payroll costs. The coronavirus, aid, relief and economic security (cares) act, signed into law in march 2020, included a payroll tax deferral under section 2302. Half of the deferred amount is due on december 31, 2021, and the other half is due on december 31, 2022. Cares act allows employers to defer employer portion of social security payroll taxes.

Source: youtube.com

Source: youtube.com

The payroll tax deferral period begins on march 27, 2020 and ends december 31, 2020. This relief applies to all employers, including governmental entities. Payroll tax deferral and employee retention credit. Half of the deferred amount is due by dec. Posted at 02:13h in blog by stephanie 0 comments.

Source: tagpay.com

Source: tagpay.com

We expect that withheld amounts of income and payroll taxes remitted to the treasury department will jump in late december as a result of the payment of payroll tax amounts that were allowed by. The cares act provides employers with a choice in the case of an otherwise eligible entity between (1) using the employee retention credit in conjunction with the payroll tax deferral, or (2) qualifying for an sba forgivable loan to fund payroll costs. Employees should see their deferred taxes in the withholdings from their pay. The cares act temporarily allows business losses to be carried back to offset recent years’ taxable income and For whom does the cares act provide a payroll tax deferral?

Source: blog.smithschafer.com

Late repayment would subject all deferrals to penalty. We expect that withheld amounts of income and payroll taxes remitted to the treasury department will jump in late december as a result of the payment of payroll tax amounts that were allowed by. Cares act payroll tax deferral: National covid relief for businesses. The cares act requires that the employer, not the payroll service provider, is responsible for ensuring the deferred payroll tax is remitted timely by the applicable deferral date.

The coronavirus aid, relief, and economic security act (“act”) contains several business relief provisions, including an employer payroll tax deferral (“deferral”) and a companion provision allowing an employee retention credit (“credit”). The cares act allows employers to defer payment for the employer portion of payroll taxes—6.2% for social security taxes—due from march 27, 2020, through december 31, 2020. Section 2302 of the cares act only applies to taxes incurred from march 27th through dec. All employers can defer making some social security tax payments under the cares act. The cares act allowed businesses to elect to defer the employer�s share of social security tax on wages paid to employees between april 1 and december 31, 2020.

Source: proseer.co

Source: proseer.co

Payments of certain payroll taxes can be delayed. We expect that withheld amounts of income and payroll taxes remitted to the treasury department will jump in late december as a result of the payment of payroll tax amounts that were allowed by. Cares act allows employers to defer employer portion of social security payroll taxes. The cares act provides general revenue transfers to the social security trust funds in the event that the employer payroll tax deferral results in a loss of revenue. Section 2302 of the cares act enables employers to defer certain payroll taxes, specifically the employer contribution of federal insurance contributions act (fica) taxes, otherwise referred to as the employer’s portion of social security taxes.

Source: socialsecurityreport.org

Source: socialsecurityreport.org

The coronavirus aid, relief, and economic security act (act) contains several business relief provisions, including an employer payroll tax deferral (deferral) and a companion provision allowing an employee retention credit (credit). Cares act social security tax deferrals: Employees should see their deferred taxes in the withholdings from their pay. Some countries have taken various measures to cope with the covid situation to curb the. In addition to potentially receiving the ssi tax credit, the cares act allows employers to defer the payment of the employer’s share of the 6.2% social security tax on wages paid beginning on march 27, 2020 and ending on december 31, 2020.

Source: youtube.com

Source: youtube.com

It appears that the employee retention credit may be paired with the payroll tax deferral. Half of the deferred amount is due on december 31, 2021, and the other half is due on december 31, 2022. 31, 2021, with the other half due by. Cares act social security tax deferrals: Payroll tax deferral and employee retention credit.

Source: youtube.com

Source: youtube.com

The cares act allows employers to defer payment for the employer portion of payroll taxes—6.2% for social security taxes—due from march 27, 2020, through december 31, 2020. Section 2302 of the cares act enables employers to defer certain payroll taxes, specifically the employer contribution of federal insurance contributions act (fica) taxes, otherwise referred to as the employer’s portion of social security taxes. The cares act allows an employer to defer payments of the employer portion of the social security tax. The coronavirus aid, relief, and economic security act (act) contains several business relief provisions, including an employer payroll tax deferral (deferral) and a companion provision allowing an employee retention credit (credit). A brief overview of the deferral is included in our cares.

Source: rogerrossmeislcpa.com

Source: rogerrossmeislcpa.com

Employers may defer payment of 50% of the employer’s social security tax depositthat would normally be required to be paid between march 27, 2020 and december 31, 2020. How to repay the deferred taxes. Employers can make the deferral payments through the electronic federal tax payment system or by credit or debit card, money order or with a check. This content is for the first stimulus relief package, the coronavirus aid, relief and economic security act (cares act), which was signed into law in march 2020. It appears that the employee retention credit may be paired with the payroll tax deferral.

Source: trinet.com

Source: trinet.com

The cares act provides employers with a choice in the case of an otherwise eligible entity between (1) using the employee retention credit in conjunction with the payroll tax deferral, or (2) qualifying for an sba forgivable loan to fund payroll costs. Section 2302 of the cares act only applies to taxes incurred from march 27th through dec. It allows employers to defer depositing and paying the employer�s share of social security taxes (6.2%). Employees should see their deferred taxes in the withholdings from their pay. What is the cares act?

Source: mossadams.com

Source: mossadams.com

The payroll tax deferral period begins on march 27, 2020 and ends december 31, 2020. 31, 2021, and the other half by dec. Employers may defer payment of 50% of the employer’s social security tax depositthat would normally be required to be paid between march 27, 2020 and december 31, 2020. Deferral of social security tax deposits the cares act allows employers to defer deposits of their 6.2% share of the social security tax due from march 27, 2020, through dec. 50% by december 31, 2021, and 50% by december 31, 2022.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cares act payroll tax deferral by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Car rental plattsburgh ny information

- Car window tinting prices near me Idea

- Car rental bluffton sc Idea

- Car wash scottsdale information

- Cars strip weathers Idea

- Car rental ithaca ny information

- Care 4 kids information

- Car jack rental Idea

- Centerville family eye care information

- Car towing information